This holiday season will be key to economic recovery for many small businesses emerging from lockdowns this year.

Professional Beauty spoke to Marty Pomeroy Chief Executive Officer at Smartpay to understand simple ways salons can increase their profit margins, and chatted with one small business that saved $14,000 a year with one simple operations adjustment.

Marty Pomeroy says it’s no secret that the professional beauty industry has been one of the most previously impacted during the COVID-19 lockdowns. “Salon owners and their staff were one of the hardest-hit industries during the most recent lockdown. Probably more than any other sector, beauticians, hairstylists and salon owners need to maximise their profitability in the lead up to Christmas and re-coup mid-year losses” he tells Professional Beauty.

The saving grace for small businesses is that this time around, consumer sentiment is in the right place. “I think now more than the last lockdown, Australians are very keen to celebrate engaging in some in-person spending off the back of high vaccination rates and low risk of another lockdown.” But how can salons maximize profits during the busiest time of the year?

Pomeroy’s tips:

“I’d recommend the sector review their business costs and try to reduce these where they can.

December is always a busy time for salons and retailers with Christmas shopping, parties and functions. The most common expenses for SME businesses leading up to Christmas are staffing costs and supporting overheads.”

Review the “small” expenses:

During one of the busiest periods for the Australian beauty industry on record, it might not be realistic to cut down on major costs like staffing.

Marty says some of the greatest cost-efficiencies can be found in the small details.

“While it might be hard to cut down on staffing during such a peak time, quick cost-savings can be made by reviewing all business expenses, including electricity, mobile phone costs or alternative suppliers. We would also suggest doing the same for your EFTPOS – a quick call to a specialist EFTPOS provider could save you thousands of dollars. A recent survey by Canstar found that merchants pay on average $400 per month or almost $5,000 per year in EFTPOS transaction fees which is a saving they could make by moving to an EFTPOS specialist.

There is no working around that cash use has declined significantly, and card transactions have increased during the COVID pandemic. This means merchants are paying higher transaction fees. “Card payments in 2021 are up 13.1% in 2020, and digital wallet payments have jumped 90% in the same period, with 68 million monthly transitions.”

Pomeroy tells Professional Beauty that instead of encouraging cash which can seem unprofessional, particularly in a hygiene conscious COVID-19 environment, opting out of a bundle can be the best way to save. “More than three quarters (78%) of businesses always stick with the same bank provider, even though 63% of them believe they could get a better deal by shopping around.”

He adds that small businesses can expect support from the Australian consumers: “With 87% of consumers preferencing supporting small business over major retailers, and half of them willing to pay more, there’s never been a better time for recovery.”

Implementing surcharges in salon:

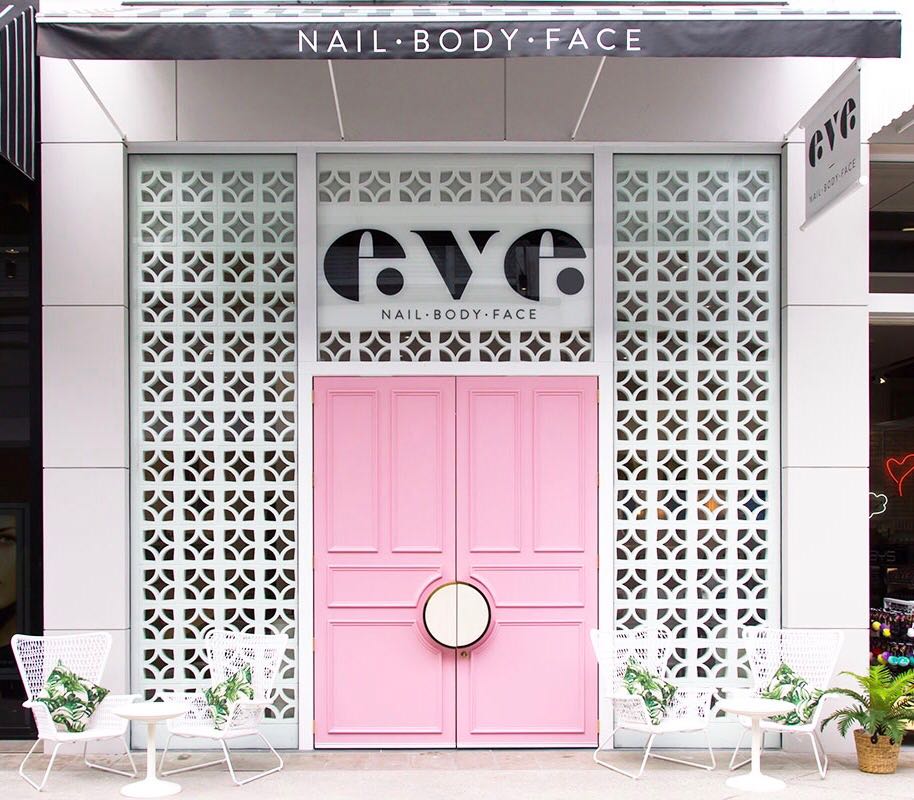

Karen of Eve Nail Lounge at Broadbeach Waters said that her Eftpos bills cost her close to $1200 a month before skipping the bank. She said by switching to SMART PAY, she saved significant money. Zero Cost EFTPOS adds a surcharge to the total for the customer to pay. Karen said this also made things easier for her staff: “It’s automatic, so my staff don’t need to think about the numbers. They continue to look after our customers’ nails. The terminal is mobile, so some customers pay while they’re in the chair.”

While Karen was nervous about the surcharge, she is yet to receive negative reactions. “I was a little nervous about the surcharge and the potential impact on my very loyal customers. We placed signs on the counter and made sure to mention surcharge to every before they paid – I am happy to say I have not lost any business due to surcharging.” She said switching to a surcharge model has saved her business $14,000 annually – a saving she is investing in social media advertising to bring in new business. She said the savings and subsequent growth have placed her in the position to consider expanding: “We are now in a position where we’re considering expanding our business to other locations.”

Want more tips on salon operations from PB? Check out our Salon Reopening Roadmap and SMS Marketing features.

Read the current issue of our digital magazine here:

- For more news and updates, subscribe to our weekly newsletter

- Follow us on Instagram

- Like us on Facebook

- Join Australia’s largest network of beauty industry professionals on LinkedIn

- Subscribe to our print magazine

Have an idea for a story or want to see a topic covered on our site and in our pages? Get in touch at info@professionalbeauty.com.au.